In the U.S. and all over the world, businesses are struggling to keep afloat with the pandemic taking a massive toll in lives and businesses. The U.S. auto industry, which in 2018 contributed 2.7% of the country’s GDP, faces an uncertain future even with the push to reopen the economy.

Automakers have seen disruptions with three months of full and partial shutdowns of plants from March onward. Now, the spike in Corona virus cases is threatening a repeat of the second quarter.

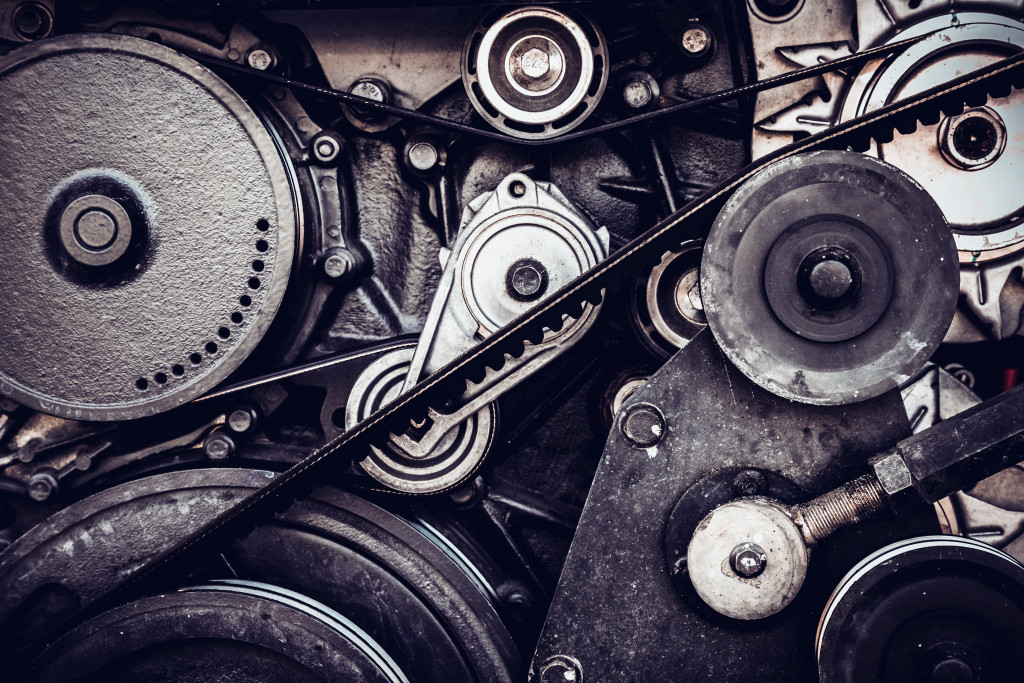

As the auto industry struggles to cope, one bright spot presents itself to industry investors: the aftermarket parts segment. Despite everything, this sector has been able to weather the worst that the pandemic threw at it, and is even making gains.

What is it about the car aftermarket business that made it thrive? We can find some clues based on its performance in past financial crises, as well as how it has already made the shift online, even before the pandemic and recession hit.

The car aftermarket industry is remarkably recession-proof

The third-party aftermarket is pretty resilient to recessions. For example, the financial crisis of’ 07-’08 saw the automotive market struggle. From 17 million cars sold annually in North America, sales slumped to 10 million. Despite this, the auto parts aftermarket did well—so well, in fact, it grew 1.1% in those years. When the American economy recovered in the years after, the industry shot back up to pre-recession levels and past.

In spite of the demographic of new car buyers skewing older (and can be expected to “age out” of the market), industry experts are still confident that aftermarket parts will still do well. As recently as June 2020, the sales of car parts hit $49 billion, contributing to an industry still projected to hit $282 billion by the end of the year. Even if the market isn’t buying new cars, older vehicles will require more parts, from car stereo installation to tires and grill upgrades.

This is the car parts market’s “win-win–” whether car owners buy a new or used car, there will always be a demand for parts. Even more so, for older models.

Digital is Driving the Car Industry

As with every other company trying to survive in 2020, it comes down to how well companies can shift to operating and selling online. As most suppliers and distributors already had an online presence, this shift was smoother than other industries’.

The result of this massive shift to ecommerce? Automotive digital marketing agency Hedges and Company reports that since July saw a 33% increase in online sales for parts and accessories over March. In 2019, that same period saw a 3% decrease.

Because of the stiff competition by smaller third-party aftermarket parts suppliers, they made the shift to online selling long ago, which made adapting to the social distancing and operational disruptions of 2020 easier.

Looking at the future

While the situation is still too volatile, and there are too many unknowns to make predictions about what the world will look like post-pandemic, we can be fairly certain that the auto aftermarket industry will do well for itself.

Having weathered so many crises in the past, and with the demand for transportation expected to rubberband back to pre-crisis levels as soon as it’s safe to go back to “normal,” we can expect manufacturers, distributors and suppliers to be doing a brisk business—provided, of course, that they can weather the current storm until then.